39+ do property taxes come out of mortgage

But keep in mind this limit isnt just for property taxesit includes state and local income and sales taxes too otherwise known as the SALT deduction. Youll just need some information.

Free Legal Assistance Available For Pennsylvania Remnants Of Hurricane Ida Survivors Helpline 877 429 5994 Legal Aid Of Southeastern Pennsylvania

Web The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large.

. Ad 10 Best Home Loan Lenders Compared Reviewed. So if your home is worth 200000 and your property tax. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Lock Your Rate Today. Comparisons Trusted by 55000000. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Property tax assessed value of a property x tax rate The assessed value of your property is rarely equivalent to its market value which can. Get Instantly Matched With Your Ideal Mortgage Lender.

They dont come out of your paycheck and you. Web How to deduct property taxes on your tax return Homeowners can deduct up to 10000 5000 if married filing separately for a combination of property taxes and either state. Web So for every 1000 of assessed home value you would owe 20 in property taxes.

File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web You may be wondering how your property taxes are collected especially if this is your first time owning a home.

Lock Your Rate Today. Web But to put it simply. 1 You may think Oh good I dont pay that much for property taxes.

Web You may have to pay up to six months worth of property taxes and maybe even a years worth of insurance up front. Web First if you have a down payment of less than 20 you wont have enough equity in your home for your lender to consider allowing you to pay your property taxes. Web The amount you owe in property taxes is fairly easy to calculate.

Escrow accounts are set up to collect property. The property tax percentage. Ad Find Yakima County Online Property Taxes Info From 2022.

If your homes assessed value is 250000 your property tax bill would be. The assessed value of the home. Get Instantly Matched With Your Ideal Mortgage Lender.

Searching Up-To-Date Property Records By County Just Got Easier. Ad 10 Best Home Loan Lenders Compared Reviewed. Web The IRS caps the property tax deduction at 10000 5000 if youre married filing separately.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Comparisons Trusted by 55000000.

73698 E County Road 22 Byers Co 80103 Zillow

12146 E Highway 318 Fort Mc Coy Fl 32134 Mls Om638740 Trulia

Indiaherald100114 By India Herald Issuu

2426 County Road 243 Westcliffe Co 81252 Compass

Understanding Property Taxes At Closing American Family Insurance

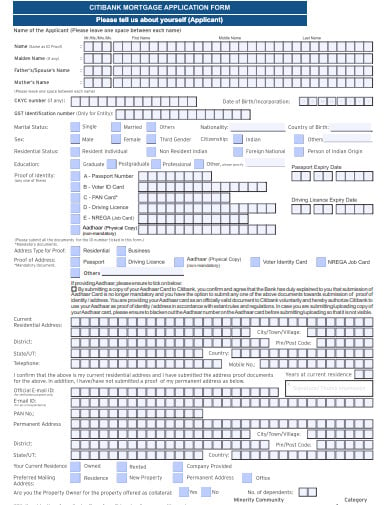

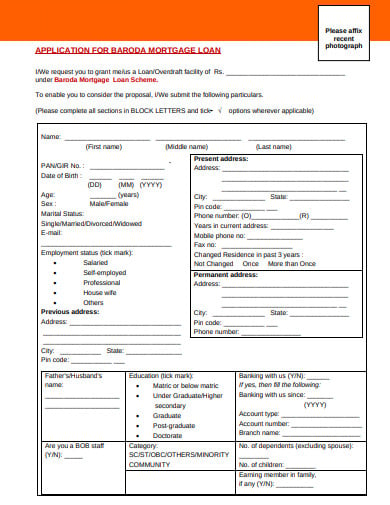

10 Mortgage Form Templates In Pdf Doc

Banick

Are Property Taxes Included In Mortgage Payments Sofi

Understanding Property Taxes Home Loans

13031 Crowfoot Springs Road Larkspur Co 80118 Compass

39 W Dorsey Ln Hyde Park Ny 12538 Realtor Com

Property Tax Calculator Estimator For Real Estate And Homes

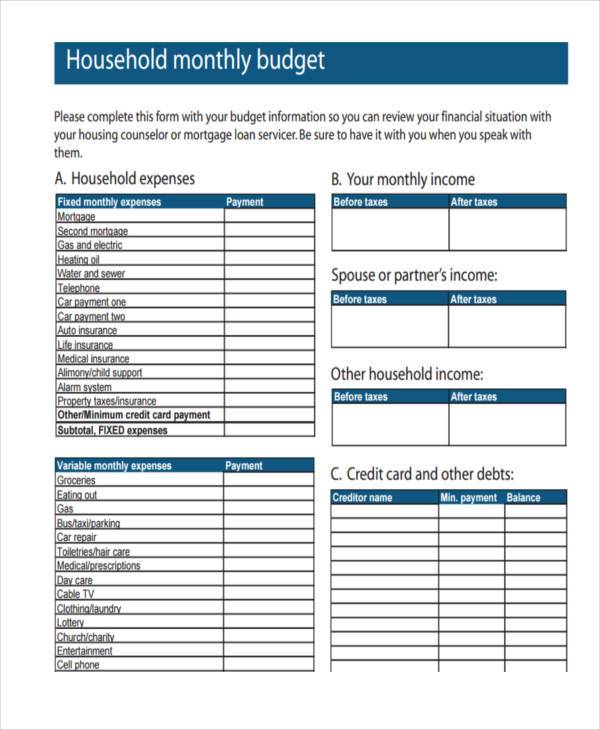

Free 39 Sample Budget Forms In Pdf Excel Ms Word

6 Ways To Get Approved For A Mortgage Without Tax Returns In 2023

What You Should Know About Property Taxes In California Nicki Karen

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

10 Mortgage Form Templates In Pdf Doc